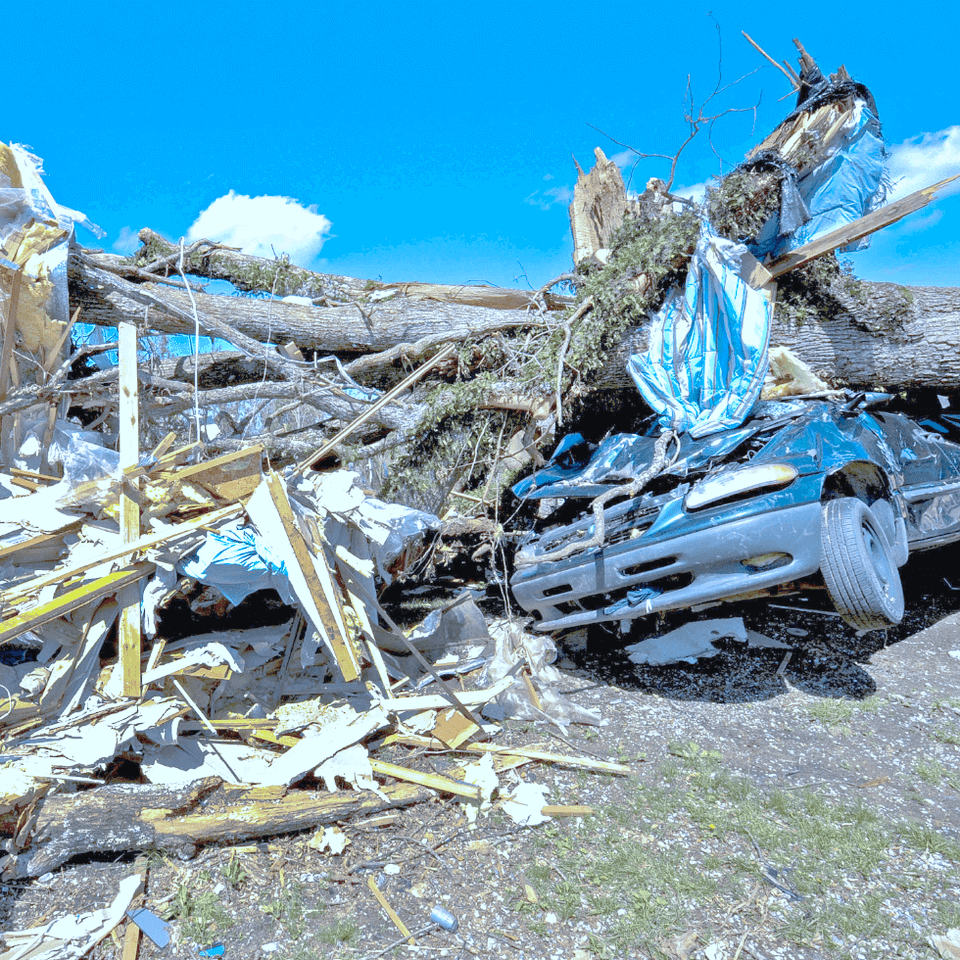

Your Business's Personal Property Is Safe in Southaven, MS and Byhalia, MS

We write commercial property policies for:

- Restaurants

- Offices

- Churches

- Retail businesses

- Manufacturers

- Lawyers

- Doctors

- Dentists

- Mini storage facilities

- Automobile dealers

- Garage operations

- Property managers

- Rental properties

- Hotels / Motels

- Convenience stores

- Veterinarians

- Nonprofit organizations