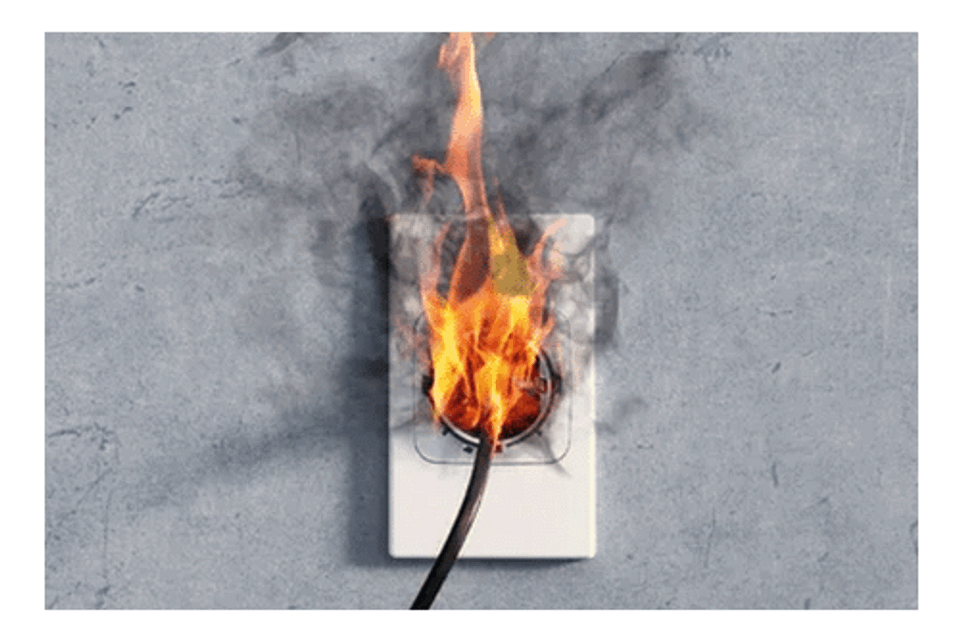

Does homeowners insurance cover fire?

Yes, your homeowners insurance covers fire. Generally, you insure your home at 50-70% of its value. Some homeowners will find that the coverage limits on their homeowners insurance are not enough to cover both the value of their home and its contents.

For example, you have an extensive home studio with costly audio equipment and rare or collector's musical instruments. A standard home insurance policy will not offer the coverage amount that you require to replace these items, but you have several options to extend your coverage.

Learn about our personal umbrella policies.

For example, you have an extensive home studio with costly audio equipment and rare or collector's musical instruments. A standard home insurance policy will not offer the coverage amount that you require to replace these items, but you have several options to extend your coverage.

- Supplemental fire insurance policy

- Personal umbrella insurance policy

-

Extended coverage amount on your homeowners policy

Learn about our personal umbrella policies.