The benefits of commercial auto insurance: is it worth it in Southaven, MS and Byhalia, MS?

As a business owner, you make hard decisions on a daily basis. Some choices, however, should be easy. Deciding whether or not to get commercial vehicle insurance is one of them. Unfortunately, many company leaders find themselves wondering: what is commercial auto insurance?

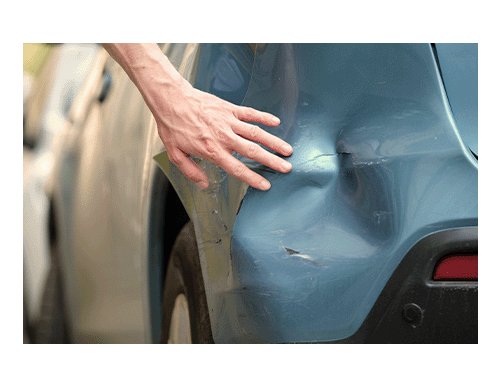

If your company relies on vehicles to get work done, taking out a commercial auto insurance policy is in your best interest. Regardless of whether you're operating a single work truck or a whole fleet of company cars, the potential benefits of commercial auto insurance far outweigh the risks of not having it.

If your company relies on vehicles to get work done, taking out a commercial auto insurance policy is in your best interest. Regardless of whether you're operating a single work truck or a whole fleet of company cars, the potential benefits of commercial auto insurance far outweigh the risks of not having it.

- The benefits of commercial auto insurance greatly outweigh the risks of going without

- Make smart business decisions with commercial auto coverage